Five Key Types of Life Insurance: A Guide to Making the Right Choice

Choosing the perfect life insurance can feel like navigating a maze. But did you know that picking the right policy can significantly impact your financial security and peace of mind? Let’s delve into the specifics of the five prominent life insurance options, helping you make an informed choice tailored to your needs.

Term Life Insurance: The Simplicity of Short-Term Protection

Term life insurance often emerges as the most straightforward and affordable option for many, offering a financial cushion for a specified period without the complexity of investment elements.

- Best Suited For: Those seeking cost-effective, temporary coverage, ranging from a decade to three decades.

- Mechanism: A term life policy remains active for a set term. You pay premiums during this period, and if you pass away within this timeframe, a predetermined sum (the death benefit) is given to your beneficiaries.

- Pros: Affordable with straightforward terms.

- Cons: Its limited duration may not coincide with life’s unpredictable milestones.

Whole Life Insurance: Lifelong Coverage with Investment Benefits

Whole life insurance is a type of permanent coverage known for its lifetime validity and an investment-like, tax-deferred cash value component.

- Best Suited For: Affluent individuals eyeing low-risk investment diversification or those with long-term dependent care needs.

- Mechanism: Premiums contribute to both the death benefit and a cash value account, accruing interest.

- Pros: Dual benefits of investment and lifetime coverage.

- Cons: Higher premiums and can be intricate due to its investment component.

Universal Life Insurance: Flexibility At Its Best

Universal life insurance offers a permanent coverage solution with the flexibility to adjust premiums.

- Best Suited For: High-earners wanting flexible premium structures.

- Mechanism: Adjust your premiums and death benefit based on your financial standing, even using the policy's cash value for premium payments.

- Pros: Tailored premium amounts.

- Cons: Potential risks associated with market fluctuations affecting the cash value.

Variable Life Insurance: Dive into Market-Linked Rewards and Risks

Variable life insurance lets you invest your policy’s cash value in multiple funds, offering a high-reward, high-risk mechanism.

- Best Suited For: High-income individuals looking for diverse investment avenues alongside solid coverage.

- Mechanism: The policy’s cash value can be invested in market-linked funds, affecting both the death benefit and cash value.

- Pros: Prospects of higher returns.

- Cons: Market-based risk exposure.

Final Expense Insurance: Ensuring Peace During Final Moments

Final expense or burial insurance focuses on providing a small sum to cover funeral expenses and other end-of-life costs.

- Best Suited For: Those facing challenges qualifying for conventional policies, including seniors or individuals with major health issues.

- Mechanism: With basic health questions, this policy provides instant coverage with a modest benefit.

- Pros: Simplified qualification process.

- Cons: Costly given the minimal coverage amount.

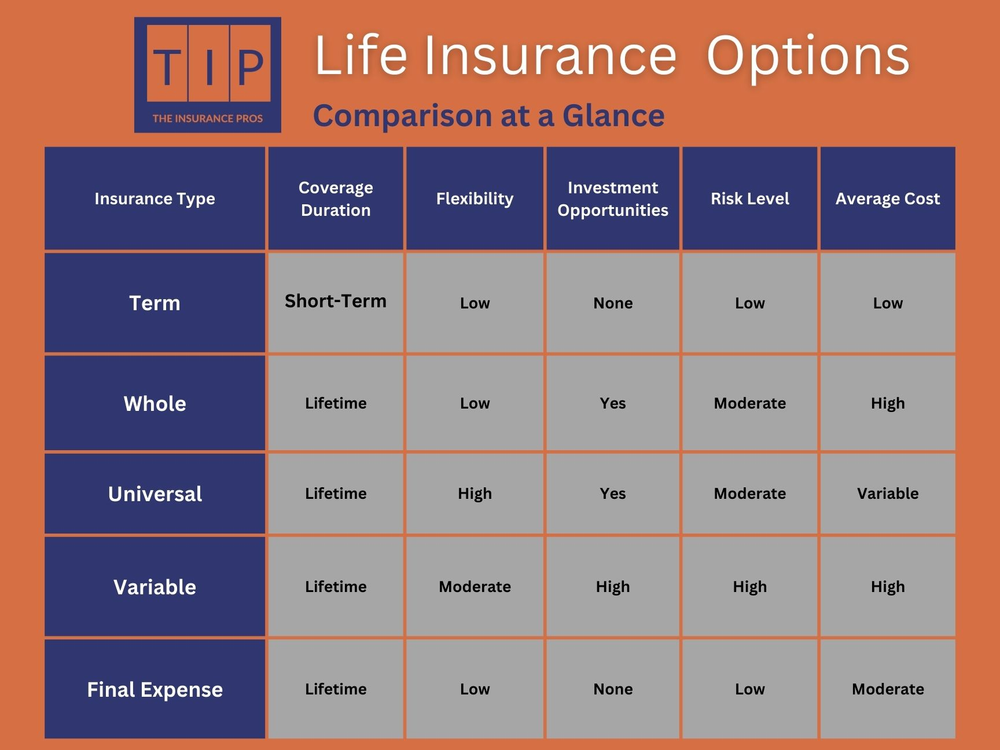

Comparison at a Glance

---

Your Next Steps

Still feeling overwhelmed? Understandable. Remember, every individual’s circumstances, desired coverage, and financial constraints are unique. Consultation can often be the bridge between confusion and clarity.

Why Consult with a Professional?

Choosing life insurance isn't just about the present moment. It's about safeguarding the future, sometimes in ways we might not currently anticipate. A financial advisor, especially one well-versed in life insurance, can offer tailored insights, helping you sidestep potential pitfalls.

Let Us Simplify Life Insurance For You!

At The Insurance Pros, our experts are equipped to guide you through the intricate landscape of life insurance, delivering unbiased and lucid advice. Whether it's a detailed query or a simple doubt, we're here to help. Contact us and let's chat about your best options!

FAQ Section:

- What is a death benefit?

- It's the sum your beneficiaries receive upon your passing as per the terms of your life insurance policy.

- Is "cash value" the same as the death benefit?

- No, cash value is an investment-like component in certain life insurance policies. It grows tax-deferred and can be borrowed against or withdrawn. However, it’s separate from the death benefit.

- Can I switch between policy types?

- It depends on your policy terms and the insurance provider. Some policies offer conversion options, but it's essential to discuss this with your insurer or financial advisor.

For a deeper understanding or to address specific queries, feel free to explore our range of articles, videos, and other resources. Making the right life insurance decision is a big deal, and we’re committed to helping you every step of the way.

Hey Bosses: The “One Big Beautiful Bill” Is Here to Shake Up Your Health Plan. Let’s Not Get Played.