HSA vs. FSA: Which One’s Better for You?

Ever stare at your benefits enrollment screen (or that 52-page HR doc) and think, “Did I just stumble into an episode of Alphabet Soup: Insurance Edition?”

HSA? FSA? HDHP? IRS?

It feels like trying to solve a Rubik’s Cube while wearing oven mitts. But don’t stress—I’ve got your back. Let’s unpack two of the most confusing and most valuable players in your health-and-money playbook: the Health Savings Account (HSA) and the Flexible Spending Account (FSA).

Here’s the deal: both are awesome. But only one may be the MVP for you.

So, What Are They?

Both HSAs and FSAs let you stash away pre-tax dollars to pay for qualified medical expenses. Think of them as your personal medical piggy banks—for co-pays, prescriptions, dental work, and even that chiropractor you’ve been low-key avoiding.

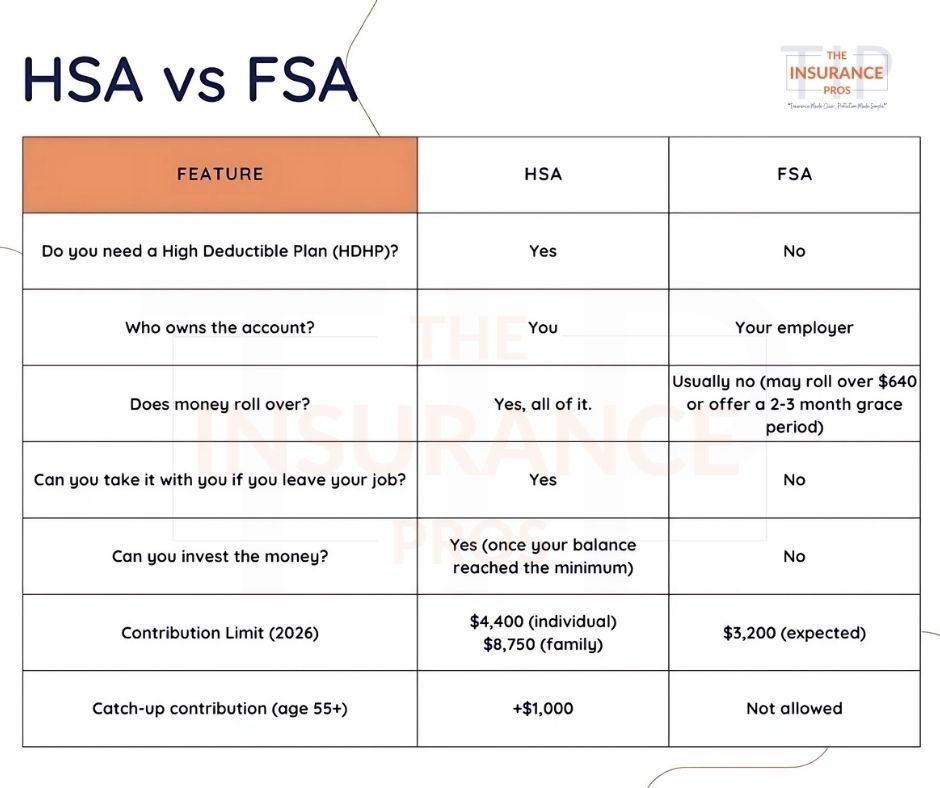

But they’re not twins. There are a few key differences—like who qualifies, how they’re managed, and what happens if you don’t use the funds.

HSA vs. FSA: Let’s Break It Down

👉 Go with an HSA if:

- You’re enrolled in a High Deductible Health Plan (HDHP)

- You want a triple-tax-advantaged account that grows over time

- You’re into investing your healthcare funds (yes, it’s a thing!)

- You’re healthy and won’t need to drain the account each year

- You like control—it’s your account, your money, your call

👉 Choose an FSA if:

- You don’t have an HDHP but still want to save pre-tax for healthcare

- You’ll likely use all (or most) of the money within the year

- You want the full yearly amount available upfront

- You’re covering dependent care costs—like daycare or after-school programs

Quick Heads-Up: The FSA Trap

That “use it or lose it” rule on FSAs? Totally real. If you don’t spend the funds by year-end (or within the short grace period), that money could bounce back to your employer. It's like filling your fridge with groceries and then handing them over to your neighbor because you forgot to eat.

HSAs? They’re ride-or-die. Yours to keep forever—even through retirement.

Carmen’s Take

I’m a big fan of the HSA—it’s flexible, powerful, and can double as a long-term savings strategy. But FSAs? Still a solid win if you know you’ll use that money on things like braces, contact lenses, or prescriptions that rival your car payment.

Bottom line: Know what fits your life right now. That’s the real flex.

👣 What’s Next?

✔️ Not sure what your current plan qualifies you for? Let’s talk—book a free consult.

✔️ Already enrolled but unsure how to make the most of it? Reply with “Review mine!”

✔️ Want a simple one-page HSA vs. FSA Cheat Sheet? Just reply with “Send the cheat sheet!”

Thanks for letting me translate this benefits chaos into something that actually makes sense. You deserve to understand your options and feel good using them.

PS: Stick around—next up, I’m decoding HRAs. Because why stop now?

With clarity (and a side of sass),

Carmen

The Insurance Pros

Hey Bosses: The “One Big Beautiful Bill” Is Here to Shake Up Your Health Plan. Let’s Not Get Played.